Union Bank Home Loan Interest Rates | Unlock the Best Deals for Your Home

Union Bank Home Loan Interest Rates: Union Bank of India offers home loans with interest rates starting at 8.50% per year and flexible repayment options up to 30 years. Loans range from ₹2 lakh to ₹10 crore, making it suitable for both salaried and self employed people. The bank also has low processing fees, no prepayment charges, and a simple way to calculate your EMIs.

With its competitive rates and easy eligibility, Union Bank is a great choice for affordable home loans.

Union Bank Home Loan Interest Rates (2024)

Union Bank of India is a reliable choice for home loans, offering low interest rates and flexible repayment options to suit different needs. Whether you’re buying your first home, transferring your loan from another bank, or looking for affordable EMIs, Union Bank has you covered.

With a focus on simple processes and customer satisfaction, it stands out as a great option compared to other banks like SBI, Axis Bank, and Bank of Baroda. This makes it easy to compare rates and pick the best loan for your dream home.

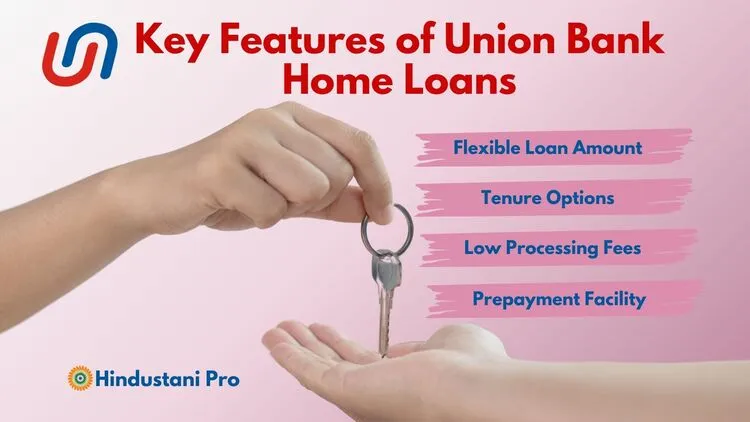

Key Features of Union Bank Home Loan Interest Rates

Union Bank’s home loan products are designed with flexibility and affordability in mind. Here are some of the key highlights:

- Flexible Loan Amount: Loan amounts range from ₹2 lakh to ₹10 crore, suitable for both first time buyers and property investors.

- Tenure Options: With loan tenures of up to 30 years, you can choose a repayment plan that aligns with your financial goals.

- Low Processing Fees: Union Bank ensures affordability by charging minimal processing fees.

- Prepayment Facility: Borrowers can reduce their interest burden with no prepayment penalties, similar to offerings like PNB home loan interest rates.

- Home Loan Rate Calculator: Use the Union Bank home loan calculator to estimate your EMI and plan repayments efficiently.

Comparing Union Bank with Other Banks

When evaluating home loans, it’s crucial to consider various factors like interest rates, tenure options, and additional benefits. Here’s how Union Bank compares with other prominent banks:

- Union Home Loan: Known for competitive rates and flexible terms.

- SBI Home Loan Interest Rate: Offers slightly lower starting rates but may have stricter eligibility criteria.

- Axis Bank Home Loan Interest Rate: Ideal for salaried professionals but slightly higher interest rates.

- Bank of Baroda Home Loan Interest Rate: Attractive rates for women borrowers and affordable balance transfer options.

- Bank of India Home Loan Interest Rate: Competitive rates with faster processing.

By using Union Bank’s home loan rate calculator, you can compare these options and choose the best fit for your needs. Check out our guide on Business Ideas for Women to empower your financial journey.

Union Bank’s Focus on Low Interest Home Loans

Union Bank is committed to offering low interest home loans to make housing accessible to all. Borrowers with a good credit score, stable income, and existing relationships with the bank often qualify for even better rates. This focus makes Union Bank a strong competitor in the home loan comparison market.

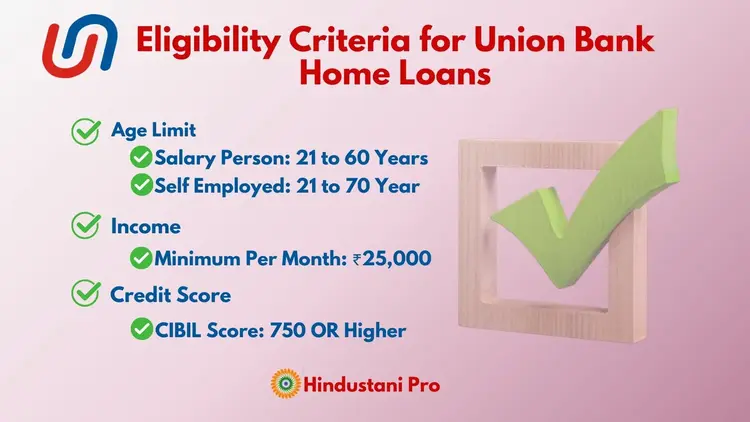

Eligibility Criteria to Get for Union Bank Home Loans

To qualify for a home loan with Union Bank, applicants must meet the following criteria:

- Age: 21 to 60 years for salaried individuals and up to 70 years for self-employed professionals.

- Income: Minimum monthly income of ₹25,000.

- Credit Score: A CIBIL score 750 or higher improves your chances of securing the best rates.

These criteria are consistent with other lenders like PNB home loan interest rates and Axis Bank home loan interest rates.

How to Reduce Your Home Loan Interest Rates?

To secure the lowest possible rate on your home loan:

- Improve Your Credit Score: Higher credit scores often lead to better rates.

- Shorter Loan Tenure: Opting for a shorter tenure can help reduce the overall interest burden.

- Balance Transfer Facility: Transfer your existing loan to Union Bank for a lower home loan rate reduction.

- Compare Rates: Use tools like a home loan calculator to evaluate different lenders, including SBI home loan interest rates and PNB fixed deposit schemes, to find the best option.

Fixed vs. Adjustable Rate Home Loans

Union Bank offers both fixed home loan rates and adjustable rate home loans, providing flexibility for borrowers. Fixed rates are ideal for those who prefer predictable EMIs, while adjustable rates can benefit from market fluctuations.

Bottom line

Union Bank home loan interest rates are among the most competitive in the market, making it a top choice for borrowers. Whether you’re considering a Union Bank of India home loan interest rate, comparing housing loan interest rates, or exploring options like SBI home loan interest rates and Bank of Baroda home loan interest rates, Union Bank delivers a balanced mix of affordability and flexibility.

Start your journey toward homeownership today with Union Bank’s customer friendly offerings and use the home loan rate calculator to plan your finances effectively.