Smart Insurance Companies in India | Benefits

Smart Insurance is a modern type of insurance that uses new technology, like mobile apps and smart devices, to make the insurance process easier and faster. It allows customers to manage their policies easily through apps, and it helps speed up claims processing with the help of AI.

Insurance also suggests personalized tips based on your driving habits, making it more suitable and accessible for everyone.

This article will provide complete information about insurance companies in India, including their benefits, login procedures, app functionalities, policy downloads, and the claims process.

Smart insurance in India

Insurance in India is a new way of using technology to make insurance easier, cheaper, and more personalized. It uses mobile apps, AI, and smart devices for better service.

Benefits of Insurance in India

- Lower Costs: You can pay less if you drive safely or maintain good health.

- Convenience: You can buy, manage, and claim insurance quickly using mobile apps or websites.

- Faster Claims: AI technology helps settle claims faster, sometimes within minutes.

Also Check, MTNL Share Price| Online Buying and Selling in India

Smart Insurance Company Details in India

Many companies in India are working on insurance, utilizing technology to improve their services, streamline claims processing, and upgrade customer experience. Some of the insurance companies in India:

- ICICI Lombard General Insurance

- HDFC ERGO General Insurance

- Bajaj Allianz General Insurance

- Tata AIG General Insurance

- Max Bupa Health Insurance

- Reliance General Insurance

- Future Generali India Insurance

- Aditya Birla Health Insurance

- Digit Insurance

- Niva Bupa Health Insurance

Smart Insurance India login

The Smart General Insurance App is designed to help users conveniently manage their insurance policies from their smartphones. Key Features of the Smart General Insurance App are Policy Management, Claims, Processing, Premium Payments, Document Upload, and Customer Support.

How to Download the Smart General Insurance App?

For Android Users

- Open the Google Play Store on your device.

- Search for the Smart General Insurance App or the specific insurer’s app (ICICI Lombard, HDFC ERGO).

- Tap Install to download the app.

For iOS Users

- Open the Apple App Store on your device.

- Search for the Smart General Insurance App or the specific insurer’s app.

- Tap Get to download and install the app.

Steps to Log In to Insurance India

- Visit Your Insurance Provider’s Official Website: Some popular insurance providers in India include:

- ICICI Lombard

- HDFC ERGO

- Bajaj Allianz

- Tata AIG

- Look for the Login or Customer Login Button: This is usually located at the top right of the homepage.

- Enter Your Details:

- Registered mobile number or email ID

- Password or One-Time Password (OTP) sent to your mobile/email

- Click Login: Access your account to manage your policies, download documents, and file claims.

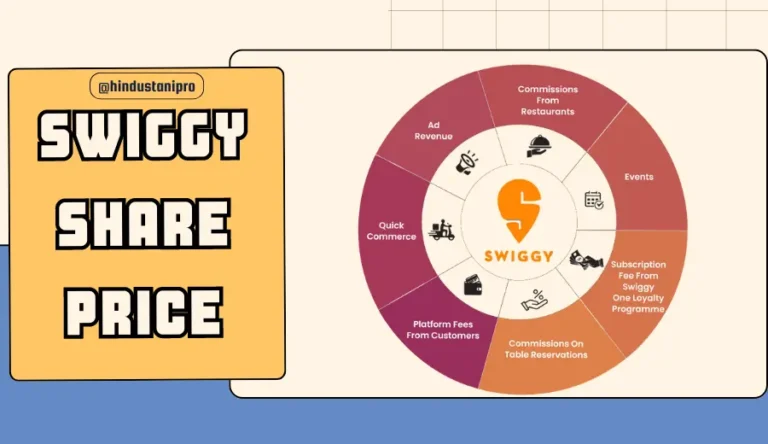

Also Check, Swiggy Share Price: Online Buy/Sell in India

Password or Issues Logging In?

If you forget your password or face login issues, most insurers offer an option to reset the password via email or OTP. Click Forgot Password on the login page and follow the instructions.

How to File a Smart Insurance Claim?

- Log In: Access the insurance company’s mobile app or website and log in to your account.

- Navigate to Claims Section: Find the section dedicated to claims, usually labeled as Claims or File a Claim.

- Fill Out the Claim Form: Provide the required information, such as policy details, incident description, and other necessary data.

- Upload Documents: Attach any supporting documents, like photos of damages or medical reports.

- Submit: Review your information and submit the claim.

- Track Status: Use the app or website to track the status of your claim and receive updates as it is processed.

Also Check, Hindustani Pro | Latest and Trending News about India

Benefits of Insurance Claims

- Convenience: Allows customers to manage claims from anywhere, anytime.

- Speed: Faster processing times lead to quicker settlements.

- Transparency: Real-time updates provide clarity and reduce anxiety during the claims process.

- Reduced Errors: Digital submissions minimize the chances of human errors.

Insurance India Policy Download

To download your Insurance India policy, follow these general steps.

- Visit the Website or App: Go to your insurance provider’s website or open their mobile app.

- Log In: Enter your registered email or mobile number and password to access your account.

- Go to Policies: Find the section labeled My Policies or Policies.

- Download Policy: Select your policy and click Download or View Policy Document.

- Check Email: You may also find a copy of your policy document in your email from when you purchased it.

Smart Insurance Phone Number

Customers can seek assistance by using the number provided below. Please feel free to reach out for any support you may need.

- 07487033906

- 06366942165

Bottom Line

Smart Insurance in India uses technology like mobile apps and AI to make insurance easier and faster.

It offers benefits like lower costs, convenience, and quicker claims. Companies like ICICI Lombard and HDFC ERGO help customers manage their policies and file claims easily. For help, you can call the numbers: 07487033906 and 06366942165.