MNSSBY Bihar Student Credit Card Scheme | Apply Online

The Bihar Student Credit Card Scheme is a government initiative designed to help students in Bihar access financial support for higher education. Under this scheme, eligible students can avail a loan of up to Rs. 4 lakh at a low interest rate of 4% per annum. The loan is repaid in easy instalment’s after a grace period of one year post-course completion, with a repayment tenure of up to 15 years.

In this article, we will discuss the process for applying for the Student Credit Card under the Sarkari Yojana, including the eligibility criteria, loan repayment policy, and other essential details.

Overview of MNSSBY Bihar Student Credit Card Yojana

The MNSSBY (Mukhyamantri Nischay Swayam Siddh Yojana), also called the Bihar Student Credit Card Yojana, is a scheme by the Bihar government to help students get financial support for higher education. It aims to remove financial barriers and help students achieve their educational goals.

|

Scheme Name |

Student Credit Card in Bihar |

|---|---|

|

Scheme Aim |

Educational Loan |

|

Launch |

Bihar Govt |

|

Loan Amount |

₹4 lakh |

|

Beneficiary |

Students of Bihar |

|

Apply Mod |

Online |

|

Official Website |

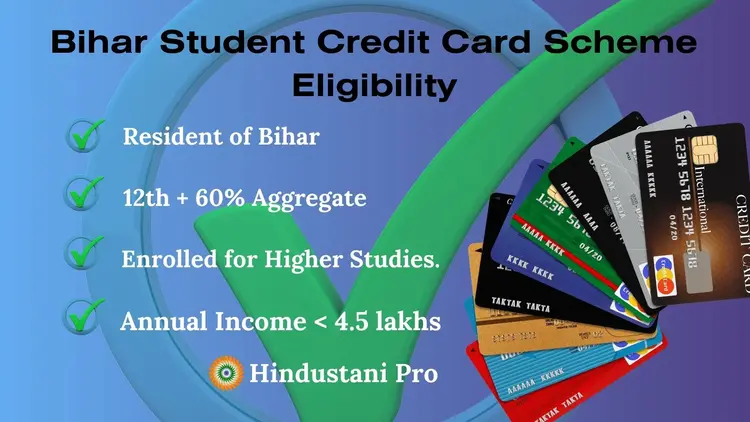

MNSSBY Bihar Student Credit Card Scheme Eligibility

To check the eligibility criteria before applying for an MNSSBY Educational loan in Bihar.

- Applicant Must be Resident of Bihar.

- You have pass 10+2 (Intermediate) with 60% Aggregate.

- Enrolled in recognized institution for Higher Studies.

- Applicant have Annual Income less then 4.5 lakhs.

Student Credit Card Age Limit:

To apply for the Student Credit Card in Bihar, your age should be a maximum of 25 years. If your age exceeds 25 years, you will not be eligible for this scheme.

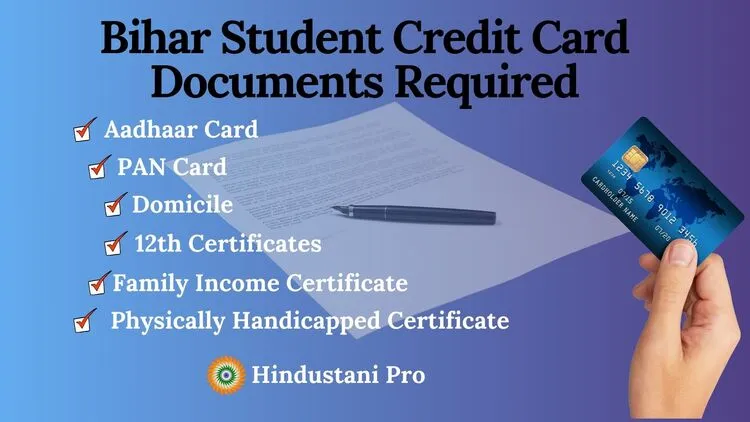

Documents Required MNSSBY Student Credit Card Bihar

To apply for a Student Credit Card in Bihar, the following documents will be required:

- Application Form

- Aadhaar Card (for identity verification)

- PAN Card

- Mobile Number & Email Id

- 10th & 12th Certificates

- Admission from

- Fee Structure form

- Domicile

- family income Certificate

- Caste Certificate (if applicable)

- Bank Account Details (for loan disbursement)

- Physically Handicapped Certificate (if applicable)

How to Apply Online for Student Credit Card Bihar Scheme

To apply online for the Student Credit Card Yojana, follow these simple steps:

- Visit the Official Website: Go to the official website.

- Register: Create an account by entering your mobile number and email address. You will receive an OTP to verify your details.

- Fill Out the Application Form: Once registered, log in and fill out the application form with your personal information, educational details, and financial background.

- Upload Documents: Upload all the required documents, such as your Aadhaar card, PAN card, 10th and 12th mark sheets, proof of admission, and income certificate.

- Submit the Application: After filling in the form and uploading documents, double check everything and submit the application.

- Receive Acknowledgment: Once your application is submitted, you’ll receive an acknowledgment with an application number. You can track the status of your application online.

Students can refer to other Bihar government schemes like EPDS Bihar for additional benefits and opportunities.

How to Check MNSSBY Student Credit Card Status in Bihar

To check the status of your Student Credit Card application, follow these steps:

- Visit the Official Website: Go to the official portal.

- Login to Your Account: Use your registered mobile number or email ID and password to log in to your account.

- Go to Application Status: After logging in, look for the “Application Status” section or tab on your dashboard.

- Check Status: Click on it, and you’ll be able to see the current status of your application, whether it’s approved, pending, or rejected.

- Track Progress: You can also track any updates or requests for additional information if required.

Students may also benefit from other initiatives like SCM Bihar for further educational support.

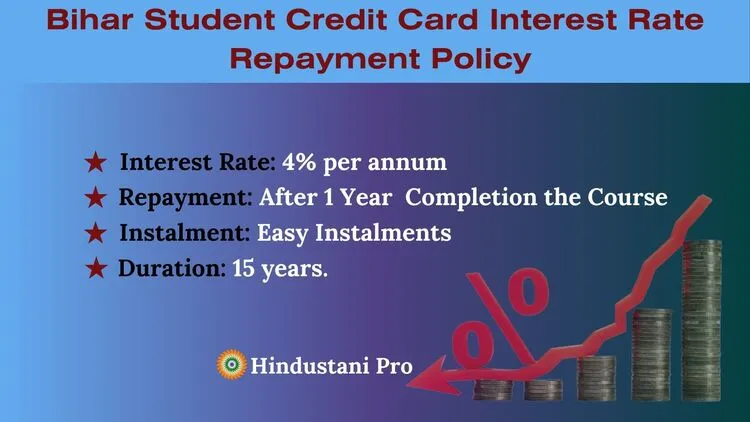

Student Credit Card Bihar Interest Rate and Repayment Policy

The Student Credit Card Bihar Yojana provides financial support to students pursuing higher education. The key details of the interest rate and repayment terms are as follows:

- Interest Rate: The loan is provided at an interest rate of 4% per annum on the total loan amount.

- Repayment: The loan repayment begins 1 year after the completion of the course.

- Repayment Period: Students can repay the loan in easy instalments over a period of up to 15 years.

List Of Eligible Courses Student Credit Card Bihar

The BSCC scheme is designed to support students pursuing higher education in various fields. The list of eligible courses includes:

- Engineering and Technology (B.Tech, B.E)

- Medical Courses (MBBS, BDS, Nursing, Paramedical)

- Management Courses (MBA, MCA, etc)

- Law (LLB, LLM)

- Agriculture and Veterinary Science

- Pharmacy

- Polytechnic Courses

- Science Courses (B.Sc, M.Sc)

- Commerce Courses (B.Com, M.Com)

- Arts Courses (BA, MA)

- Education Courses (B.Ed, M.Ed)

- Hotel Management

- Fashion Designing

- Paramedical and Nursing

- IT & Computer Science

- Other Professional and Technical Courses

Bottom Line

The Bihar Student Credit Card Scheme offers financial support to students in Bihar for higher education, providing loans of up to ₹4 lakh at a 4% interest rate. The loan repayment begins one year after course completion and can be repaid over 15 years. This initiative helps students from low-income families achieve their educational goals without financial barriers.