Atal Pension Yojana | APY Scheme Benefits, latest updates

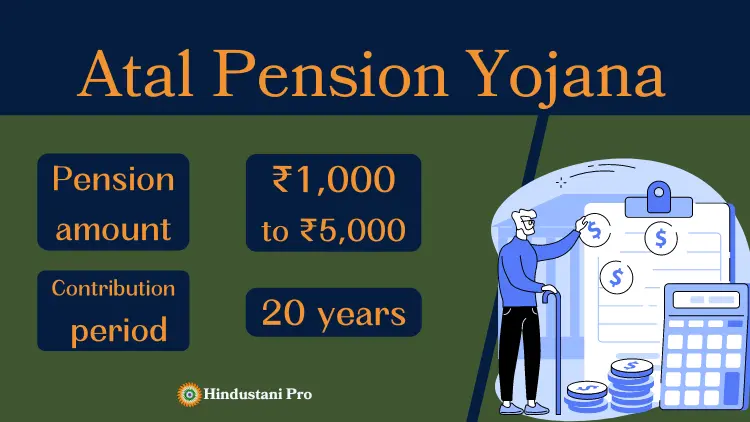

Pradhan Mantri Atal Pension Yojana (APY Scheme) helps workers save for retirement by contributing a set amount each month. After you turn 60, you’ll get a monthly pension of ₹1,000 to ₹5,000.

It’s easy to join, with extra benefits like government contributions and tax savings, making it a great choice for retirement planning. It’s a straightforward and supportive plan, ensuring a secure financial future with minimal effort.

In this article, I’ll cover the APY Chart(Atal Pension Yojana Chart), including its retirement benefits, tax advantages, death benefits, and application process. I’ll also provide details on eligibility, managing your account, and the overall impact of the scheme.

Atal Pension Yojana Details

The Atal Pension Scheme is a pension program introduced by the Indian government in 2015 to provide a steady income for low-income individuals once they retire.

Launched on May 9, 2015, and effective from June 1, 2015, it targets workers in the unorganized sector. This scheme is part of the government’s effort to create a universal social security system, especially for the poor and underprivileged.

| Events | Details |

|---|---|

| Pension amount | Up to Rs 5,000 |

| APY Age limit | 18 years – 40 years |

| Minimum Contribution period | 20 years |

| Exit age | 60 years |

Under the APY, you can receive a guaranteed monthly pension of ₹1,000 to ₹5,000 when you turn 60, depending on how much you contribute.

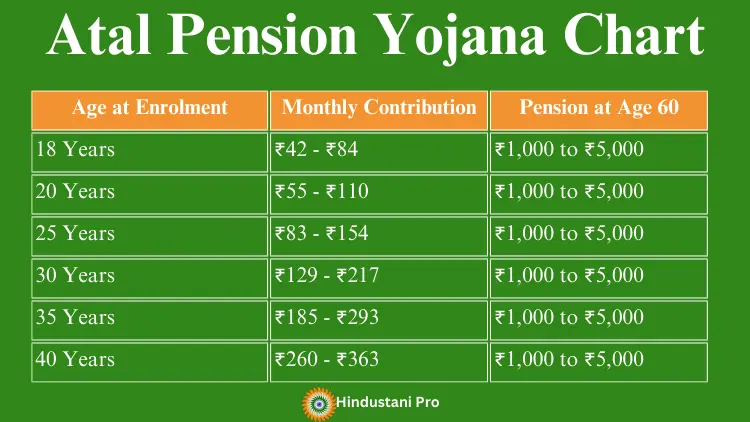

Atal Pension Yojana Chart | अटल पेंशन योजना प्रीमियम चार्ट PDF

Here’s a simplified APY Scheme Chart showing the monthly contribution needed and the pension amount received based on the age of enrollment:

| Age at Enrolment | Monthly Contribution | Pension at Age 60 |

|---|---|---|

| 18 Years | ₹42 – ₹84 | ₹1,000 to ₹5,000 |

| 20 Years | ₹55 – ₹110 | ₹1,000 to ₹5,000 |

| 25 Years | ₹83 – ₹154 | ₹1,000 to ₹5,000 |

| 30 Years | ₹129 – ₹217 | ₹1,000 to ₹5,000 |

| 35 Years | ₹185 – ₹293 | ₹1,000 to ₹5,000 |

| 40 Years | ₹260 – ₹363 | ₹1,000 to ₹5,000 |

This APY chart displays the premium contributions required based on age and the desired pension amount.

The Atal Pension Yojana age chart illustrates how contributions vary with age, and Atal pension scheme chart is essential for calculating the minimum contributions based on the pension plan chosen.

Objectives of Atal Pension Yojana

The primary objective of the (APY) is to provide a secure and guaranteed monthly pension to individuals working in the unorganized sector once they reach retirement age.

It aims to ensure financial stability for low-income workers who may not have access to formal pension schemes, thereby enhancing their financial security in retirement.

Atal Pension Yojana Benefits

The Atal Pension Scheme(APY) offers secure retirement income, tax benefits, and financial protection for your family, ensuring stability and peace of mind.

Retirement benefits

One key feature of the (APY) is the retirement pension. The monthly pension amount you receive depends on how much you deposit into the scheme.

You can choose from five pension options: ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000. The amount you need to contribute varies for each pension option. If the subscriber passes away, the pension payments will be transferred to their spouse.

Tax Benefits

Contributions to the (APY) offer tax benefits to encourage people to invest in the scheme. Besides the usual ₹1.5 lakh tax deduction, you can also get an additional ₹50,000 tax benefit under Section 80CCD (1B) if you invest in APY. This helps reduce the amount of your income that is taxed.

Death Benefits

If the APY contributor passes away, their spouse will receive the pension. If both pass away, the nominee gets the pension amount.

If the contributor dies before 60, the spouse can either keep the account active or withdraw the contributions and earnings. Investing in APY ensures financial security for the family.

Financial Security

Ensures a steady income post-retirement, enhancing financial stability for low-income workers.

Apply Online for Labour Card Scholarship

Atal Pension Yojana login

To log in to the APY portal, follow these steps:

- Visit the Official APY Website: Go to the official website or the bank’s online portal where APY services are offered.

- Find the Login Section: Look for the login or sign-in option on the homepage.

- Enter Credentials: Input your user ID or registration number and password. If you don’t have an account yet, you may need to register first.

- Verify Security: Complete any additional security steps, such as entering a CAPTCHA code or receiving a verification OTP (One-Time Password) on your registered mobile number.

- Access Your Account: Once logged in, you can manage your APY account, view your contributions, check your pension details, or make changes to your account information.

Apply Online for Atal Pension | अटल पेंशन योजना ऑनलाइन चेक

To apply Online for the (APY) online, follow these steps:

- Visit the APY Website or Bank Portal: Go to the official website or your bank’s online banking portal.

- Log In or Register: Log in with your banking credentials. If you don’t have an account, you may need to create one.

- Navigate to APY: Find and select the APY Yojana option from the list of services or schemes.

- Complete the Application Form: Fill out the application form with your details, such as name, Aadhaar number (if available), date of birth, and bank account details.

- Select Pension Option: Choose the monthly pension amount you wish to receive upon retirement (₹1,000 to ₹5,000).

- Upload Documents: If required, upload any necessary documents, such as proof of identity and address.

- Review and Submit: Review all the details you’ve entered. Submit the application form once you’ve confirmed everything is correct.

- Confirmation: You will receive a confirmation message or email once your application is successfully submitted and processed.

Documents Required for APY Scheme

- Aadhar card

- Mobile number

- ID Card

- Evidence of permanent residence

- Passport size picture

Atal Pension Scheme Form

To apply for the (APY), you need to fill out the application form. Here’s how you can obtain and fill out the form:

Online Form

- Visit the Official Website: Go to the official website or your bank’s online portal.

- Download the Form: Look for the option to download the APY application form.

- Fill Out the Form: Complete the form with your details, including your Aadhaar number (if available), mobile number, and bank account information.

Offline Form

- Visit a Bank Branch: Go to any bank branch that offers APY services.

- Request the Form: Ask for an APY application form at the bank’s customer service desk.

- Complete the Form: Fill out the form with the required details and submit it along with any necessary documents.

APY Customer Care Number

The customer care number for (APY) can vary depending on your location and the bank or financial institution managing your account. However, you can generally contact the APY customer care through the following:

Toll-Free Number: 1800-180-1111 or 1800-110-001 (for general inquiries related to APY).

Bottom Line

The Atal Pension Yojana (APY) provides financial security for low-income individuals by offering a pension of ₹1,000 to ₹5,000 after age 60. It includes tax benefits and ensures your spouse receives the pension if you pass away.