IPO GMP | Latest IPO Grey Market Premium 2024 & Kostak 2024

IPO GMP stands for Grey Market Premium. It helps us guess how popular new company shares might be before they start trading on the stock market. When a company wants to sell its shares for the first time, these shares are sometimes traded in a special, unofficial market called the grey market.

The GMP shows how much extra money people are willing to pay for these shares before they are officially sold. This can help us predict if the shares will do well once they start trading on the real stock market. Understanding IPO GMP helps investors decide if they should buy shares in the new company.

Understanding GMP in IPOs

If you’re curious about how GMP can guess IPO listing prices, you’re in the right place! GMP stands for Grey Market Premium. It tells us how much extra money people are ready to pay for a company’s shares before they are officially sold on the stock market.

This helps us guess if the shares will be worth more or less when they start trading. It’s like getting a hint about what might happen when the shares are available to everyone. Let’s make it simple!

What is GMP?

GMP (Grey Market Premium) is the extra money investors pay for shares of a company before those shares are listed on the stock market. This is like buying a toy before it hits the store shelves. The grey market is unofficial, meaning it’s not controlled by the stock market, but it still gives us clues about how much people want the shares.

Latest IPO GMP Today

Right now, GMP helps us guess how well new shares might do when they start selling. For example, the GMP for the Data Patterns IPO is around ₹300 to ₹330. This means people think the shares might start selling at a much higher price than the original price set by the company, which is between ₹555 and ₹585 per share. If the GMP is ₹300, the expected starting price might be around ₹885 (original price + GMP).

| IPO Name | GMP | Original Price | GMP % |

|---|---|---|---|

| Vraj Iron | 20 | 207 | 9.7% |

| Allied Blenders | 57 | 281 | 20.3% |

| Stanley Life Styles | 160 | 369 | 43.4% |

Latest SME IPO GMP

SME IPOs (Small and Medium Enterprises) often have high GMP figures, showing strong interest. Here’s a list of recent SME IPOs with their GMP:

| SME IPO Name | GMP | Original Price | GMP % |

|---|---|---|---|

| Deanston Tech | 0 | 100 | 0.0% |

| Divine Power | 40 | 40 | 100.0% |

| Akiko Global Services | 18 | 77 | 23.4% |

| Petro Carbon | 85 | 171 | 49.7% |

What Does IPO GMP Tell Us?

GMP shows how much extra people are willing to pay for shares before they officially start trading. A high GMP means a lot of people want the shares, so the price might be high when they start selling. A low or negative GMP means less interest, and the price might be lower.

How to Calculate GMP

To figure out the expected listing price with GMP:

- Know the Original Price: This is the price set by the company for the shares.

- Find the GMP: Look at how much extra people are paying in the grey market.

- Add GMP to Original Price: For example, if the GMP is ₹100 and the original price is ₹200, the estimated starting price will be ₹300.

What is IPO Kostak Rate?

The Kostak Rate is the extra money someone can get by selling their chance to buy IPO shares before they are officially listed. It’s like making a quick profit for selling the opportunity to buy shares, even if you don’t actually get any shares.

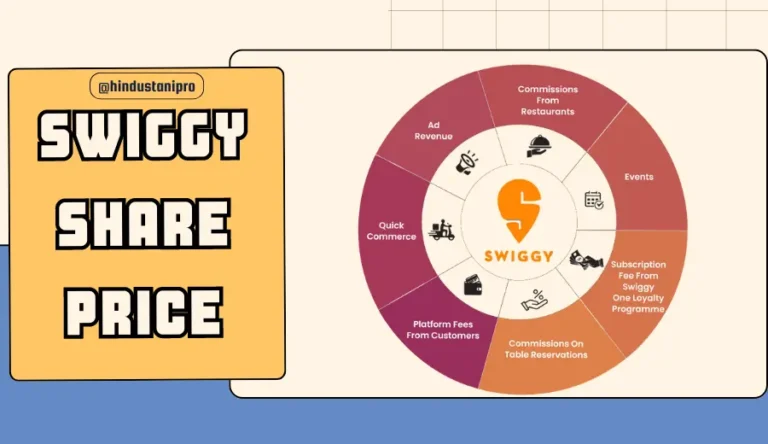

Swiggy Share Price

Swiggy, a popular food delivery company, is planning to sell shares to the public for the first time, a process called an IPO (Initial Public Offering). This means people can buy parts of the company and own a piece of it. Swiggy’s biggest owner is Prosus, which holds 33% of the company. Other important owners include SoftBank, Tencent, and Accel.

Important Points About IPO GMP

- Grey Market Transactions: These are not official and rely on trust between investors and brokers.

- IPO Analysis: Always check the company’s details before investing.

- Market Conditions: GMP can change based on market feelings and demand.

- Regulatory Risks: Trading in the grey market is not legal, so be careful.

Factors Influencing GMP

- Market Sentiment: If people feel good about the stock market, GMP can be higher.

- Demand and Supply: High demand can increase GMP.

- Company Performance: Good company performance can positively affect GMP.

- FPI Activity: Investments from foreign investors can influence GMP.

Subject to Sauda

This is a deal where someone agrees to buy shares at a certain price if they get the shares. It’s like saying, I’ll buy this toy if I can get it when it’s available.

GMP Calculation Steps

- Understand the IPO Price: Find out the price set by the company.

- Check Grey Market Rates: See how much people are paying in the grey market.

- Calculate GMP: Subtract the original price from the grey market price.

Are Grey Market Stocks Safe?

Grey market stocks are not as safe because they are not officially regulated. Prices can be very different from what you might see on the stock market.

Buying/Selling IPO Applications in the Grey Market

In the grey market, you can buy or sell IPO applications through local brokers. Make sure to work with trusted brokers to avoid risks, as grey market trading is not officially regulated.

How GMP Works?

GMP helps us guess how much a company’s shares might be worth when they start trading. Before the IPO (Initial Public Offering) officially begins, shares are traded unofficially. GMP is the extra amount people are willing to pay above the IPO price. By adding the GMP to the IPO price, we can estimate the listing price.

Why GMP Matters?

GMP is useful because it shows how excited investors are about a company. A high GMP means people are very interested, while a low GMP might show less excitement or some concerns about the company.

How to Use GMP Information!

A high GMP might suggest the IPO will do well, but it’s not guaranteed. To use GMP effectively, research the company’s business and financial health, check overall market trends, and consider seeking advice from financial experts.

Risks and Challenges

Investing based on GMP has risks. The unofficial market can be unstable, GMP can change quickly, and there may be fraud risks since the market isn’t regulated.

Alternatives to GMP

If you’re unsure about GMP, look at the company’s earnings, growth potential, and management. Also, consider overall market conditions and review the company’s financial reports.

Tracking GMP Over Time

GMP can change as the IPO date gets closer. To stay updated, check GMP updates regularly, follow financial news, and consult with brokers for insights.

Impact of GMP on IPO Strategy

Investors use GMP to make decisions. A high GMP might attract more investors, and companies might adjust the IPO price based on GMP. GMP also affects how people perceive the IPO’s value.

Real-Life Examples

For example, if an IPO has a GMP of ₹200 and the IPO price is ₹400, the estimated listing price could be ₹600, showing strong interest. On the other hand, if an IPO has a GMP of ₹0 and the IPO price is ₹200, the shares might list close to ₹200, indicating less interest.

Bottom Line

IPO GMP, or Grey Market Premium, helps us guess how well new company shares might do before they start trading on the stock market. It shows how much extra money people are willing to pay for these shares in the unofficial grey market. While it gives us a hint about the shares’ future performance, it’s just one part of the picture. Always do more research and consider other factors before making investment decisions.

FAQ’s