Swiggy Share Price: Online Buy/Sell in India

Swiggy, This company is a big player in its industry, with a market cap of ₹108276 crores. The current Swiggy Share Price is ₹355. Over the past year, the highest price of the stock was ₹550, and the lowest was ₹352.

Even though the company is not making a profit right now, as shown by its negative earnings per share (EPS) of -11.48, it is doing well in some areas. The company has no debt, which means it doesn’t owe money to anyone, and this is a good thing. It also has a price-to-book (P/B) ratio of 10.22, meaning people are willing to pay more for the company’s value.

With 212.31 crore shares available, the company remains popular in the market. It is considered an important company despite some challenges.

Swiggy Share Price

As of now, Swiggy is not listed on the National Stock Exchange (NSE) or any other public exchange in India. The company remains privately held, and its shares are traded in the unlisted market. There is ongoing speculation about Swiggy launching an Initial Public Offering (IPO), but no official date has been confirmed yet. Until the IPO happens, Swiggy shares cannot be purchased directly on the NSE.

How to buy Swiggy Shares?

Since Swiggy is not publicly listed on any stock exchange like the NSE or BSE, its shares cannot be bought directly like publicly traded stocks. However, there are a few ways to acquire Swiggy shares while it remains a privately held company:

Unlisted Shares Market

Swiggy’s shares are traded in the unlisted market, where private investors buy and sell shares of privately held companies. You can contact brokers who specialize in unlisted shares to inquire about purchasing Swiggy shares.

Employee Stock Options (ESOPs)

Swiggy employees may receive stock options as part of their compensation package. Sometimes, employees can sell these shares in the unlisted market. Buying these shares from current or former employees is another option.

Private Equity or Venture Capital

If you’re an accredited investor, you might be able to participate in private equity funds or venture capital rounds that invest in Swiggy. However, this option is usually available to institutional or high-net-worth investors.

Wait for the IPO

Swiggy is speculated to launch an Initial Public Offering (IPO) in the near future. Once listed, shares can be purchased easily on public stock exchanges like the NSE or BSE.

It’s important to note that buying unlisted shares carries risks, including lower liquidity and lack of transparent financial information.

Swiggy Unlisted Share Price Details

| Attribute | Value |

|---|---|

| Face Value | INR 1 per share |

| ISIN Code | INE00H001014 |

| Lot Size | 500 shares |

| Demat Status | Both (NSDL, CDSL) |

| Unlisted Share Price | INR 355 per share |

| Market Cap | INR 108276crore |

| Total Number of Shares | 212.31 crore shares |

| 52-Week High | INR 550 |

| 52-Week Low | INR 390 |

| EPS | -11.48 |

| P/B Ratio | 10.22 |

| Stock P/E | 25.9 |

| Book Value | INR 45.3 |

| Debt to Equity | 0 |

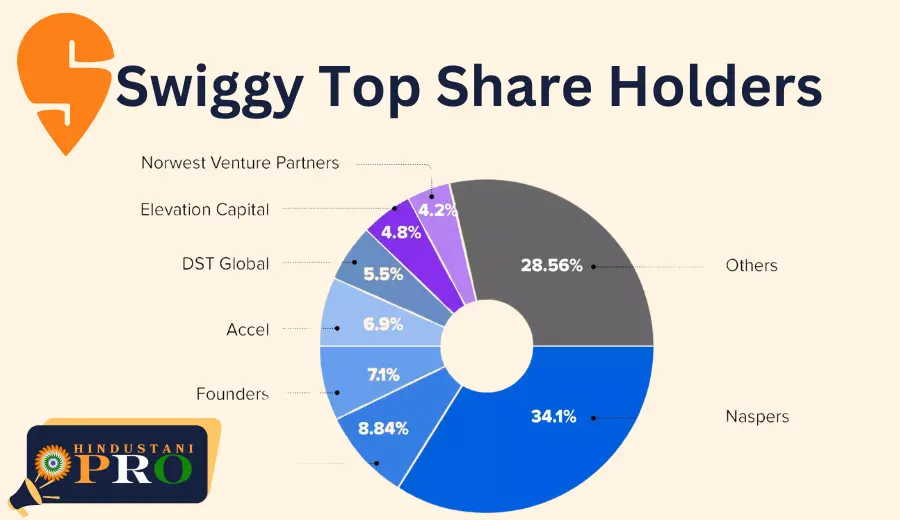

Top Shareholders of Swiggy

Swiggy, a major player in the food delivery industry in India, is preparing to launch an Initial Public Offering (IPO) in 2025. This move will allow the public to buy shares of the company, making them part-owners. Swiggy’s top shareholders include some prominent global investors and its co-founders.

Top Shareholders

- Prosus: This company owns the largest part, 33%, of Swiggy.

- SoftBank: Another big investor in Swiggy.

- Tencent: A large company from China that owns part of Swiggy.

- Accel: A firm that invests in many tech companies, including Swiggy.

- Elevation Capital: This company has been investing in Swiggy from the early days.

- Meituan: A big food delivery company from China that has invested in Swiggy.

- Norwest Venture Partners: Another firm that owns part of Swiggy.

- DST Global: Known for investing in internet companies, including Swiggy.

- Qatar Investment Authority: The wealth fund of Qatar has a stake in Swiggy.

- Coatue: A hedge fund that has invested in Swiggy.

- Alpha Wave Global: Another important investor in Swiggy.

- Invesco: An asset management company that owns shares in Swiggy.

- Hillhouse Capital Group: An investment firm with a stake in Swiggy.

- GIC: The wealth fund of Singapore, also a part-owner of Swiggy.

Founders’ Shareholding

- Sriharsha Majety: He owns 4.2% of the company.

- Nandan Reddy: He owns 1.6% of the company.

- Rahul Jaimini: He used to work at Swiggy and still owns 1.2%

Swiggy will use the money from selling shares to make their services better and grow the company.

Shareholding Pattern

| Shareholder Name | Percentage Holding |

|---|---|

| Prosus (Naspers) | 36.01% |

| SoftBank | 9.09% |

| Accel India | 7.13% |

| Apoletto Asia & DST | 5.63% |

| Saif/Elevation | 5.00% |

Swiggy Share Price Financial Metrics

| Particulars | FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|---|

| Revenue (INR crore) | 3,468.1 | 2,546.9 | 5,704.9 | 8,264.6 | 11,247 |

| Revenue Growth (%) | 207.37 | (25.56) | 123.99 | 44.87 | 36.07 |

| Expenses (INR crore) | 5,742.5 | 2,189.7 | 9,574.0 | 12,884.0 | N/A |

| Net Income (INR crore) | (3,918.5) | (1,616.7) | (3,628.9) | (4,179.3) | (2,350) |

| Margin (%) | (112.99) | (63.48) | (63.61) | (50.57) | N/A |

| EPS | (1,805.5) | (99.0) | (221.0) | (235.0) | N/A |

| EBITDA Margin (%) | (110.47) | (51.0) | (62.58) | (62.84) | N/A |

See Also: IPO GMP | Latest IPO Grey Market Premium 2024 & Kostak 2024

Swiggy Share Price Peer Comparison

| Company | 3-yr Sales CAGR (%) | EPS | Net Margin (%) | Market Cap (INR crore) |

|---|---|---|---|---|

| Swiggy | 33.57 | (235.0) | (50.57) | 6,411 |

| Zomato | 82.47 | 0.40 | 2.90 | 1,71,457 |

Swiggy’s Board of Directors

- Sriharsha Majety, CEO and Co-Founder

- Lakshmi Nandan Reddy Obul, Director

- Suparna Mitra, Independent Director

- Mallika Srinivasan, Independent Director

- Shailesh Haribhakti, Independent Director

- Sahil Barua, Independent Director

- Ashutosh Sharma, Nominee Director

Products & Services

- Food Delivery: Core service connecting consumers with restaurant partners.

- Grocery Delivery: Expanding into everyday essentials delivery.

- Dine Out: Offering dining experiences at partnered restaurants.

- Insta Mart: Providing quick delivery of daily essentials.

Swiggy’s Subsidiary Companies

- Scootsy Logistics Private Limited

- Supr Infotech Solutions Private Limited

- Loyal Hospitality Private Limited

Bottom Line

Swiggy, currently a privately held company, is not yet listed on public exchanges like NSE or BSE. To acquire Swiggy Share Price, you can explore the unlisted shares market, employee stock options, or private equity investments. Many are anticipating Swiggy’s Initial Public Offering (IPO) expected in 2024, which will allow public trading of its shares.